|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Run 3 Credit Reports: Understanding, Accessing, and Analyzing Your Financial Health

Monitoring your credit is essential for maintaining a healthy financial profile. By running 3 credit reports, you can gain comprehensive insights into your credit history. This article explores the importance of these reports and how you can efficiently access them.

What Are Credit Reports?

Credit reports are detailed accounts of your credit history, compiled by credit bureaus. They include information about your credit accounts, payment history, and credit inquiries.

The Three Major Credit Bureaus

- Equifax: Offers comprehensive credit monitoring services and detailed reports.

- Experian: Known for providing a wide array of credit-related products.

- TransUnion: Offers personalized credit insights and recommendations.

Why Run 3 Credit Reports?

Accessing all three reports is crucial as each bureau may have slightly different information. This ensures you catch discrepancies or errors that could affect your credit score.

Benefits of Comprehensive Credit Monitoring

- Identify Errors: Catch mistakes that could hurt your score.

- Fraud Detection: Spot unauthorized activities early.

- Better Loan Terms: Improve your score to secure better interest rates.

To get my real credit score, accessing these reports is the first step in managing your financial future.

How to Access Your Credit Reports

Under federal law, you are entitled to one free credit report from each of the three major bureaus every year.

Steps to Obtain Your Reports

- Visit AnnualCreditReport.com: The official website to request your free reports.

- Provide Personal Information: Ensure all details match your financial records.

- Review Each Report: Carefully check each report for accuracy.

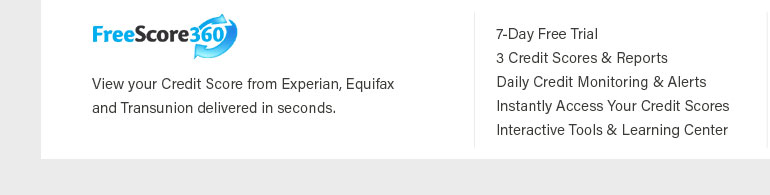

For those looking to get real credit score information quickly, consider using online services that compile all three reports into one summary.

FAQ Section

What is the best time to run my credit reports?

It's recommended to run your reports at least annually, or before major financial decisions such as applying for a mortgage or loan.

How can errors in credit reports be corrected?

Contact the credit bureau directly with documentation supporting your claim. They are required by law to investigate and correct any inaccuracies.

Will checking my own credit reports affect my score?

No, pulling your own credit reports is considered a soft inquiry and does not impact your credit score.

FREE Credit Reports. Federal law allows you to: - Get a free copy of your credit report every 12 months from each credit reporting company. - Ensure that the ...

Also, I wonder if you get all 3 free weekly credit reports in March ... credit scores until this country is up and running again. Most ...

Know where you stand with access to your 3-bureau VantageScore credit scores and report - Help monitor your credit and Social Security number - Uncover potential ...

![]()